Menu |

Information

Information

A. General overview about the Dong Nai

| Area

: |

5.907,1 km2 |

|---|---|

| Population : | 2.639.845 people (2011) |

Capital : |

Bien Hoa City |

| Administrative units : | 1 city, 1 town, 9 districts |

| Region : | Southeastern Vietnam |

| Calling code : | 61 |

| Postal code: | 81 |

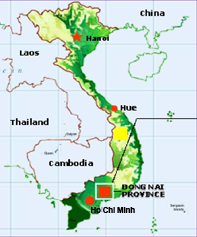

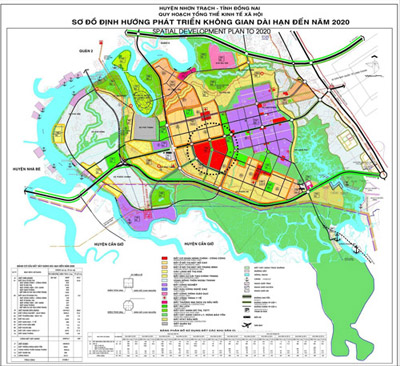

1. Location:

To the west, Dong Nai province borders Ho Chi Minh City. To the North West,

it borders Binh Duong and Binh Phuoc. On its eastern side, it borders Binh

Thuan. To the North East, it borders Lam Dong and the province borders Ba

Ria - Vung Tau on its southern side. Dong Nai is located right at the economic

center zone of the South. It is also the most dynamic area in Vietnam in terms

of economic development.

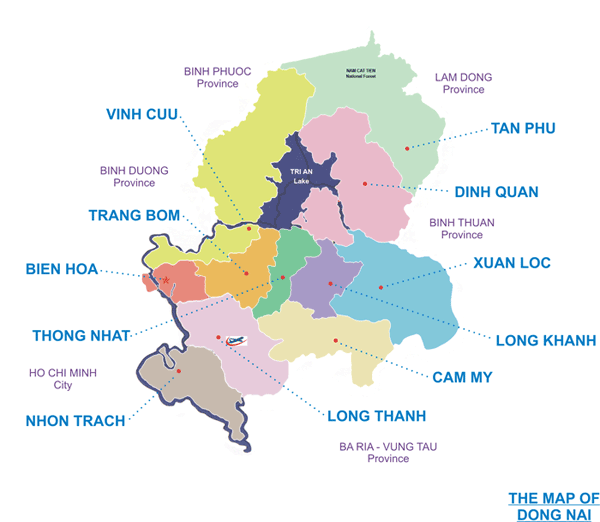

2. Administrative unit, area and population:

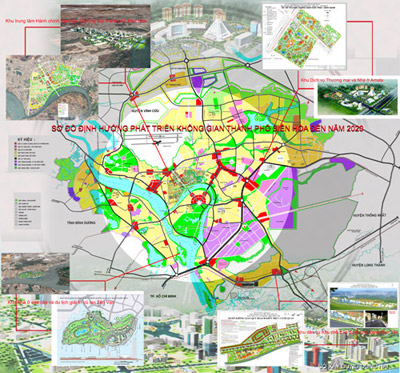

Dong Nai province has 11 administrative units with 171 communities, wards,

and towns, including Bien Hoa City as the political, economic and cultural

center of the province, the town of Long Khanh province and 9 other districts:

Long Thanh, Nhon Trach, Vinh Cuu, Trang Bom, Thong Nhat, Dinh Quan, Tan Phu,

Cam My, Xuan loc.

Natrual area in Dong Nai is about 5,907.1 km2, with a population of 2.64 million

people, it is one of the largest and most populated province of Vietnam: Urban

population of Dong Nai is 33.23% and the agricultural population is 66.73%.

| STT | Administrative unit | The number of wards, communities and towns | Area (Km2) | Population 2011 (person) |

|---|---|---|---|---|

| Total | 171 | 5.907,1 | 2.639.845 | |

| 1 | Bien Hoa City | 30 | 263,48 | 840.353 |

| 2 | Long Khanh Town | 15 | 191,86 | 134.029 |

| 3 | Long Thanh District | 15 | 430,661 | 204.040 |

| 4 | Nhon Trach District | 12 | 410,78 | 176.968 |

| 5 | Vinh Cuu District | 12 | 1095,706 | 133.910 |

| 6 | Trang Bom District | 17 | 323,685 | 267.098 |

| 7 | Thong Nhat District | 10 | 247,236 | 154.591 |

| 8 | Cam My District | 13 | 468,548 | 146.278 |

| 9 | Xuan Loc District | 15 | 727,195 | 221.473 |

| 10 | Dinh Quan District | 14 | 971,09 | 201.247 |

| 11 | Tan Phu District | 18 | 776,929 | 159.857 |

Infrastructural advantages

1. Electricity: The province uses the common national electricity supply line. In 2011, 7.13 billion kwh of electricity is consumed within the province. The 110/22 KV electrical grid system with its substations has a total capacity of 3379.75 MVA. The 22 KV medium voltage grid covers 171 wards, towns, and communities across the province and can satisfy investors’ demand for electricity.

2. Water supply: In 2011, the water supply capacity of Dong Nai reached 550,000 m3/day, which is sufficient for the consumption of urban residents and factories within industrial parks.

3. Communication: The telephone and telecommunication network of Dong Nai enables direct communication with other provinces within the country as well as with other countries. These network includes high-speed Internet (ADSL), data transmission (DDN,xDSL, Frame relay, Leased line...), Video Conference, etc. Fast delivery services such as Fedex, DHL, EMS, CPN, etc. are available. In 2011, there are 146 phone subscribers over every 100 persons on average. 30.5% of the population has access to the internet.

4. Transportation:

A highway Ho Chi Minh - Long Thanh - Dau Giay in future

Dong Nai province has a efficient road network with many national highways

going through such as national highways 1A, 20, 50, and 56; the railroad line

from the North to the South; Dong Nai is only 30 km away from Tan Son Nhat

airport, and is close to the Sai Gon Port cluster, the Thi Vai- Vung Tau port

and Dong Nai port which makes domestic and international trading more convenient.

Within the Dong Nai port cluster, the Dong Nai and Go Dau ports are in operation.

In particular, the Dong Nai port is located right at the center of Bien Hoa

city, and is near to other industrial parks. This helps reducing about 40-70

km of land transportation distance

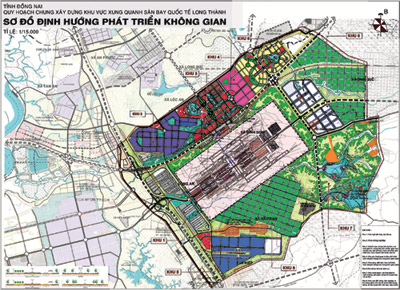

At the moment, the government is building a road network which would connect

the regions. These projects include a project to upgrade national highway

51 Bien Hoa - Vung Tau (which is planned to be completed in 2012); A highway

running through Ho Chi Minh City, Long Thành and Dau Giay with Japanese sponsorship

in under construction (planned to be completed in 2013); and there are other

plans to deploy the construction of the following important projects:

- Long Thanh International Airport which is designed to host 100 million guests/year

and 5 million tons of goods/year (this project has been approved by the Vietnamese

government, and is undergoing the process of fulfilling other requirements

to begin construction in 2015)

- Phuoc An Deep-water port, which can habors ships of 60.000 DWT capacity.

The V-group sea port cluster in Nhon Trach district can harbors ships of 30.000

DWT capacity (this project is being prepared to receive investment)

- The Bien Hoa – Vung Tau railroad

- The Bien Hoa – Vung Tau highway

- Other belt routes 3, 4 connecting the key economic zones with other regions.

The construction of the previously mentioned projects will render the province

more advantageous to investors who are interested in investing in Dong Nai.

Dong Nai’s dynamic economic development

1. Dong Nai has attracted a large number of

successful businesses with high level of efficiency:

Concerning businesses with FDI, from the begin to the end of 2011, there is an accumulated number of 1,252 approved projects with a total number of registered capital of 21.45 billion USD. 972 of these projects are still valid and belong to 35 different countries and territories. These projects have a total registered capital of 19.34 billion USD. Dong Nai province is one of the leading provinces in attracting FDI in Vietnam.

Businesses with FDI develop rapidly in size and production efficiency, displaying success in improving the investing environment and attracting investment to Dong Nai. Countries and territories that are leading in investing in Dong Nai include Taiwan, Korea, Japan, ASEAN countries, EU, United States, etc. Most foreign investors implement their projects in a serious manner, achieving positive results and have plans to expand their projects. This is highly regarded by the Vietnamese government and the province of Dong Nai.

Japan, in particular, is the one of the leading countries that contributes FDI in Dong Nai. At the end of 2011, there are 106 Japanese businesses investing in Dong Nai with a total capital of above 1.9 billion USD, including relatively large projects by Fujitsu, Olympus, Toshiba, Suzuki, Sanyo, KAO, Shiseido, NOK, Ajinomoto, Mabuchi Motor, Mitsuba M-tech, Sojitz, Kureha, New, Ojitex, Muto, Meiwa, Hisamitsu, etc. In addition, Japan also provides ODA in building the Nhon Trach water supply system. At the 1st phrase, the plant’s capacity is 100,000 m3/day. Japan is also considering other projects including the waste water processing system of Bien Hoa city; the Nhon Trach water supply system (2nd phrase) which will increase the plant’s capacity by 100,000 m3/day; There is also a construction of the workers’ residences according to the 3rd phrase of Vietnam- Japan Joint Initiative.

2. Economic growth rate and stability:

Average GDP growth rate of Dong Nai in the 2006-2010 phrase is about 13.2%.

In 2011, economic growth is 13.32%, GDP per capita is 1,789 USD.

The economic structure is changing toward industrialization. Up to 2011, the

construction industry has a share of 57.3% of the economic structure; the

service industry had a share of 35.2%; agriculture, forestry and fisheries

accounted for 7.5%.

Ceramics in Bien Hoa

3. Steady growth of industries:

Dong Nai is the first province that develops an industrial park, and is currently

one of the leading regions in industrial development in Vietnam.

Dong Nai has been approved by the Prime Minister for the development of 34

industrial parks with a total area of more than 11.450 ha, up to date, there

have been 31 industrial parks certified for establishing. 25 of them have

constructed the standard infrastructure and attracted 80% of rental land.

The rest of the land and other industrial parks are ready to welcome new investors.

In addition, the province of Dong Nai also has a bio-tech center in Cam My

district (209 ha) which is in operation. There are also agro-industrial complexes

in Xuan Loc and Thong Nhat districts (2,186 ha), the high-tech industrial

park in Thanh Long district (500 ha) is being prepared for investment, opening

up many opportunities for investors interested in Dong Nai.

In addition to synchronous investment in the infrastructure of the industrial

park, at the moment, the People Committee of Dong Nai has instructed administrative

units and other infrastructure companies to synchronously prepare different

services for the industrial parks such as:

+ Bureaucratic procedure is improved to simplify the processing by making

sure that paperwork can be transparently done at one administrative level,

in one place; at the moment, many industrial parks already have Japanese communication

units to support Japanese investors on investment documents and related paperwork.

+ Increasing support for recruitment and human resources training: Dong Nai

currently has 83 training centers and many new training establishments are

being opened. Within the Bien Hoa industrial park, there are currently 2 functioning

colleges operated by the General Company in charge of developing the industrial

park. Training facilities are always willing to cooperate with Japanese partners

to provide human resources training according to the demand of Japanese investors.

+ About the IT service, the province and other infrastructure companies have

a plan for a joint venture to provide complete IT service to businesses in

all industrial parks.

+ Building rental workshops: In some industrial parks such as Amata, Nhon

Trach 3, Nhon Trach 6, An Phuoc, Giang Dien, etc. infrastructure companies

invest in building workshops with many different layouts and rent them to

investors. In other industrial parks, infrastructure companies are ready to

build rental workshops according to the demand of investors.

+ Housing for workers: In addition, other industrial parks have set out land

fund for the construction of residential houses with other accompanied services

such as supermarket, Japanese restaurants, schools, healthcare, gym activities,

etc. with a convenient traffic network. The province always creates favorable

conditions for infrastructure companies when they invest in services for workers

and professionals.

+ Support businesses: Dong Nai and infrastructure companies of industrial

parks always accompany investors and provide them with support upon contact,

and with their investment inquiries throughout the process of projects.

+ Environmental protection: Dong Nai highly regard environmental issues and

sustainable development, industrial parks that have not invested in a center

waste water treatment system will not attract investment. In addition, the

province is building solid industrial waste treatment centers according to

its plan.

4. Agriculture - Forestry - Fisheries have

great production capacity:

Harvesting of rubber sap

Tan Trieu pomelo

Dong Nai is the leading company in the whole country in the production of animal feed, with many industrial livestock farms, providing a crucial supply of materials for the processing industry. In 2011, Dong Nai had more than 1.3 million livestock with about 1.174 million pigs and about 9.92 million cattle.

Aquaculture land with a total size of about 33,038 ha, is primarily located in the Tri An lake area and the submerged area of the lower Dong Nai river.

Dong Nai forests have the basic characteristics of tropical forests, with rich natural resources and biological diversity. A good representative is Nam Cat Tien national park. The total size of forest land is about 155.830 ha, 29.8% of which is covered by forest.

Assembly movers factory in Bien Hoa

5. Steady growth of commerce:

Dong Nai mostly export agricultural products such as rubber, coffee, nuts,

cashew nuts, corns, agricultural products, processed foods, and some industrial

products such as footwear, textile products, lumber and wood products, elastic

products, computers, electronic components, ceramics, electrical cables, etc.

Most of the import include raw materials such as fertilizer, concrete, construction

metals, accessories, raw materials for production, chemicals and other chemical

products, gasoline of different types, etc.

In 2011, Dong Nai reached an export level of 9.8 billion USD, an import level

of 10,6 billion USD.

6. Potentials for services and tourism:

Tran Bien literature temple

The province also focuses on investing in transportation and delivery services to ports; consultant services for investment, construction, telecommunication, communication, information technology and other financial/credit services, etc. in order to serve the increasing demand of industrial parks and residents of urban centers.

Foreign investors are allowed to own or rent houses during the process of implementing their projects in Vietnam. Individual foreigners who are hired by businesses to be managers in Vietnam for more than 1 year are allowed purchase and own real estate property for less than 50 years.

Dong Nai is a region with an ancient civilization and many valuable cultural and historical remnants and relic. The province also has a favorable environment for resting, eco-tourism, garden tourism, festival travels, etc. Some of Dong Nai’s regions have potentials for the development of tourism such as the Cat Tiên national park, Dong Nai river, the historical war zone D, the Buu Long tourist resort, Cu Lao town, Tan Trieu pomelo village, Thac Mai hot water lake, archaeological sites including: Hang Gon ancient tombs, Binh Da stone music instruments, and many other sites and tourist locations as planned by the Bien Hoa city, and districts of Nhon Trach, Trang Bom, Vinh Cuu, Tan Phu, Đinh Quan, etc.

Golf fields in Long Thanh and Trang Bom

Natural resources

1. Climate and Soil

- Dong Nai is situated in the tropical monsoon climate, with temperate weather

and rarely suffers from hurricane, flooding, and earthquake. Average yearly

temperature is 25-26 oC, with a dry season and a rainy season. The rain fall

level is about 1,5000 mm- 2,7000mm with the average humidity of 82%.

- Dong Nai’s landscape is filled with plains and pastures, soil composition

is solid and can withstand high pressure (above 2kg/cm2), which is good for

investment in industrial development and low-cost construction.

- Dong Nai has a fund for agricultural lands which are prosperous and fertile

suitable for industrial plants (such as rubber trees and coffees…), fruit

trees, food crop, and vegetables.

2. Natural resources:

- Dong Nai has a diversity of surface and underground water which are a sufficient

supply for production and domestic activities within the province and for

other areas.

- Dong Nai has rich mineral resources, especially non-metallic minerals, including

construction stones, paving stones, brick and tile clay, quartz, sand, filing

materials, kaolin clay, puzlan, laterite, soil sputtering, etc. which provide

a sufficient supply of raw materials for the construction of facilities and

for processing plants that use these related materials.

3. Dong Nai has a yound labor force which is

sufficiently trained and can provide a steady supply of labor for businesses:

- In 2011, the total number of students enrolled in grade schools is 520,173 students; the ratio of university or college students is 220 per 10,000 persons.

- Up to 2011, there have been 83 training/education institutes in operation within the province including 4 universities, 9 2-year colleges, 15 intermediate schools, 55 other occupational training schools and centers. New schools are being established to meet the social and business demand for high quality human resources. These schools focus on providing trained and educated human resources who understand Japanese working style and culture, which is ideal for the demand of Japanese investors.

In addition, Dong Nai is located near Ho Chi Minh city, which is the education center of the entire country. This renders Dong Nai a favorable location for attracting professional human resources.

PICTURES OF SOME OF JAPANESE BUSINESSES THAT HAVE INVESTMENT IN DONG NAI

Bien Hoa 1 Industrial Park, Bien Hoa 2 Industrial Park

Amata Industrial Park

Nhon Trach 3 Industrial Park, Long Thanh Industrial Park, Loteco Industrial Park

Business

Investment certificate

Implementing the policy of “Government hand

in hand with businesses”

Dong Nai implements the policy of “Government hand in hand

with businesses”, through the maintanance of social and political stability,

protection of living environment, and providing services to businesses and

workers. The policy also focuses on ensuring the safety of businessman, improving

the bureaucratic procedure to ensure transparency, reducing the paperwork

time and supportying businesses. The government meets up with businesses regularly

to be informed of the difficulties and obstacles businesses are facing to

resolve the issues in a timely manner and make sure that businesses can focus

on development investment.

Different Chambers and the People Committees of different locales all implement

the one-gate policy and “government hand in hand with businesses” for paperwork.

They are also ready to assist investors to the best of their ability in implementing

projects in Dong Nai.

For Japan specifically, the province of Dong Nai is preparing necessary conditions

to organize a communication group to communicate with Japanese investors in

Japanese. At the same time, the province also cooperate with other Japanese

consultant units to support Japanese investors coming to Dong Nai.

|

|

|

| Investment promotion in US | Investment promotion in UK | Lãnh đạo tỉnh tiếp cơ quan ngoại giao |

Implementing the one-gate administration policy:

Dong Nai implements the inter-connected one-gate administration policy that

goes to the Department of Planning and Investment (for projects outside of

the industrial parks) and the management board of Dong Nai Industrial Park

(for projects inside the industrial parks). Investors only need to contact

the previously mentioned administration offices to receive instruction and

support on related issues.

- The People Committee of Dong Nai issues investment certificate for investment

projects outside of the industrial parks (The investor has to submits the

required documents to Dong Nai’s Department of Planning and Investment so

that the department can gather infomation and submit it to the province People

Committee).

- The management board of Dong Nai Industrial Park issues investment certificate

for projects inside the industrial parks.

Depending on its size and its industry, a project may have different approval

time, but the maximum waiting time for a certificate does not exceed 45 days

since the submission of approriate documents (for projects subjected to evaluation

issuance of investment certificate) and does not exceed 15 days (for projects

that are simply signing up for registration of investment certificate).

Tax

1. LAND RENTAL TAX:

a) Land and water surface rents are exempted:

- Land and water surface rents for the construction of industrial parks’ workers

residence, dormitories for university students, projects belonging to fields

such as education healthcare, culture, sport, science and technology are exempted.

- The exemption lasts for 3 years for projects belonging to the encouraged

investment list; and at the new production sites that were orginally moved

because of city planning or due to environmental pollution.

- The exemption lasts for 7 years for projects that belong to the encouraged

investment list.

b) The annual rental rate is equal to the land’s price at the same location

x 0,5 x 1,5%.

Tam An residential

2. CORPORATE INCOME TAX:

a) Tax rate for corporate income tax is usually 25%

b) Favorable tax rate for corporate income tax is 10% for 15 years, tax exemption

lasts of 4 years, and is reduced by 50% over the next 9 years for the following

categories: newly established businesses that invest in high-tech, water plant,

power plant, water transportation system, road network, railroad; airport,

sea port, river port, railway station, software products and other important

infrastructural buildings as approved by the government prime minister.

c) Favorable corporate income tax is 10% over the entire course of the business’

operation, with the first 4 year’s tax exempted, and is reduced by 50% in

the following 5 years if the business belongs to the following fields of activities:

education-training, occupational training, healthcare, culture, sport and

environment.

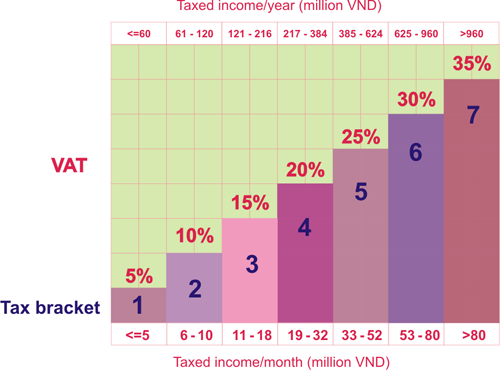

3. INDIVIDUAL INCOME TAX:

a) Partially progressive tax rate is

aplicable to income from business, salary, wage excluding the payment for

social, health insurance and occupational responsibility insurance for some

industry which are required and are accordingly excluded from tax.

| Tax bracket | Taxed income/year (million VND) | Taxed income/month (million VND) | Tax rate (%) |

| 1 | Up to 60 | Up to 5 | 5 |

| 2 | From 61 to 120 | From 6to 10 | 10 |

| 3 | From 121 to 216 | From 11 to 18 | 15 |

| 4 | From 217 to 384 | From 19 to 32 | 20 |

| 5 | From 385 to 624 | From 33 to 52 | 25 |

| 6 | From 625 to 960 | From 53 to 80 | 30 |

| 7 | Above 960 | Above 80 | 35 |

b) Full tax is applicable to income from invested

capital, transfer of capital, transfer of real estate, winning prizes, royalties,

franchising, inheritance, gift, in which:

- Income from invested capital, royalties, franchising: 5%.

- Income from transfer of capital: 20%

- Income from stock transfer: 0.1%

4. VALUE ADDED TAX (VAT):

a) Businesses are exempted from VAT if:

- Their products are livestock, agricultural plants, imported products and

commercial activities.

- Equipments, machines, specialized transportation vehicles used in production

chain, and other materials that cannot be produced domestically and have to

be imported to create fixed means of production for businesses. Equipments,

machines, transportation vehicles that cannot be produced domestically and

must be imported for the purpose of scientific research and technological

development;

b) Tax rate is 0% for export goods and export services, with the exception

of the following cases: international transportation; goods and services directly

linked to international transportation; abroad reinsurance services; credit

services, financial investment, stock investment abroad and export of raw

unprocessed natural resources.

c) Other types, depending on the type of production and business, VAT has

2 brackets: 5% and 10%.

Container Port

5. IMPORT TAX:

Imported goods to create fixed capital of business is considered the type

of investment listed in Appendix I of decree 87/2010/ND-CP issued on 13/8/2010

by the government. The decree established in details the implementation of

export tax law, import tax is exempted in the following case:

a. Equipments, machines;

b. Specialized transportation vehicles used in production chain that cannot

be produced domestically; workers transportation vehicles including 24-seat

bus and above, maritime transportation vehicles;

c. Accessories, components, detachable parts, spare parts, fittings, molds,

and other accompanying accessories used for ensembling equipments, machines,

specialized transportation vehicles as established in article a and b of this

section;

d. Materials and tools that cannot be produced domestically are used to assemble

equipments and machines necessary to the production chain or to produce components,

details, detachable parts, spare parts, fittings, molds, accessories used

for ensembling equipments, machines;

e. Construction materials that cannot be produced domestically.

g. Seeds and livestock that are allowed to be imported for the implementation

of agricultural, foresty and fisheries projects.

(With concern to high-tech projects, in addition to the above benefits, these

projects also receive import tax exemption for the duration of 5 years counting

from the first day of production that uses imported mateirals, tools and components;

non-final products that cannot be produced domestically and must be imported)

BENEFITS FOR PROJECT

1. BENEFITS FOR INDUSTRIAL PARK’S WORKERS’

HOUSING PROJECT AND URBAN LOW INCOME HOUSING:

a. Land use fee and property tax are exempted.

b. VAT rate is 0%.

c. Corporate income tax is 10% throughout the operation of the business; tax

exemption is granted for 4 years, and the tax rate is reduced by 5% for the

next 9 years (in particular, low income housing project in urban areas receives

a 50% decrease in the next 5 years).

d. Import tax is exempted for the importation of goods that help creating

fixed capital for businesses.

e. Businesses are granted favorable credit support.

g. Businesses also receive infrastructural support outside of the project

(transportation system, electricity, water system).

Khu đô thị Đông Sài Gòn

2. BENEFITS FOR EDUCATION, HEALHCARE, CULTURE

AND SPORT PROJECTS:

a. Support for renting real estate or for land clearing.

b. Land use fee and property tax are exempted.

c. Corporate income tax is 10% for the entire duration of the business, the

first 4 years are exempted from tax, and the tax rate is reduced by 50% in

the next 5 years.

d. Educational projects are not subjected to VAT.

e. Import tax is exempted for the importation of goods necessary for the creation

of fixed capital of businesses.

f. Businesses are granted favorable credit support.

g. Registration fee for land use registration is exempted, property ownership

is connected to land ownership; other fees are also exempted- other fees are

related to land use right, property ownership is connected to land ownership.

Educational institution in Bien

Hoa

3. BENEFITS FOR PROJECTS THAT INVEST IN AGRICULTURE

AND RURAL AREAS:

Projects that invest in agriculture and rural area are according to decree

61/2010/ND-CP on 04/6/2010 of the government which encourages investment in

agriculture and rural areas. Depending on the type of industry and invested

location, businesses may receive some benefits and investment support for

businesses investing in agriculture and rural areas from the government:

- Land use fee is reduced or exempted.

- Government’s land and water rental costs are reduced or exempted.

- Support for human resources training.

- Support for market development.

- Support with consultant services

- Support with scientific and technological applications.

- Support with transportation fees.

4. BENEFITS FROM INDUSTRIAL INVESTMENT SUPPORT FOR INDUSTRIAL PARKS OF DONG NAI:

a. Corporate income tax:

Corprate income tax is 25% throughout the entire duration of the business.

For projects that produce high-tech products, corporate income tax is 10%

for 15 years (on the 16th year onward, the income tax is 25%), the first 4

years are exempted from tax, corporate income tax is reduced by 50% for the

next 9 years.

b. Import tax:

Investment projects that belong to the appendix I of decree 87/2010/NĐ-CP

on 13/8/2010 by the government are subjected to the implementation of detailed

articles of import tax law. Tax exemption for import tax is as indiciated

in section 5 above.

c. Land rental cost:

Depending on the type of investment, land rental cost is exempted for 4 or

7 years since the completion of construction and the first day of operation.

d. Encouragement for market development:

- Products are advertised, and introduced for free on the webpage of the Ministry

of Trade and that of the Department of Trade.

- Businesses receive finanicial support from programs that are designed to

facilitate trade and investment.

- Businesses are put in favorable conditions to participate in supply networks

according to the regulations.

- Businesses are considered for credit from the investment development fund

of the government.

e. Encouragement for sciences and technology, human resources training

- Businesses are considered for a partial financial support from the national

scientific and technological development fund, as well as from other funds

related to sciences and technology. The support is intended to cover technological

transfering cost, purchases of copyrights, software, and hiring of foreign

professionals.

- Businesses receive partial financial support for human resources training.

LIST OF INDUSTRIAL PARKS

(Click header to sort)

| I. Functioning industrial parks |

| Number | Name | Total planned area size (ha) |

Area size (ha) |

Rental area size (ha) |

Rented area size (ha) |

Filling ratio (%) |

|---|---|---|---|---|---|---|

| 1 | Bien Hoa 1 | 335 | 335 | 248,48 | 248,48 | 100 |

| 2 | Bien Hoa 2 | 365 | 365 | 261 | 261 | 100 |

| 3 | Amata | 694 | 494 | 314,08 | 252,02 | 80,24 |

| 4 | Loteco | 100 | 100 | 71,58 | 71,58 | 100 |

| 5 | Ho Nai | 497 | 226 | 151,17 | 139,46 | 92,25 |

| 6 | Song May | 474 | 250 | 178,13 | 135,92 | 76,30 |

| 7 | Go Dau | 184 | 184 | 136,7 | 136,7 | 100 |

| 8 | Long Thanh | 488 | 488 | 282,74 | 224,03 | 79,24 |

| 9 | Tam Phuoc | 323 | 323 | 214,74 | 219,12 | 102,04 |

| 10 | Nhon Trach 1 | 430 | 430 | 311,25 | 280,97 | 90,27 |

| 11 | Nhon Trach 2 | 347 | 347 | 257,24 | 260,51 | 101,27 |

| 12 | Nhon Trach 2 - Nhon Phu | 183 | 183 | 126,31 | 69,41 | 54,95 |

| 13 | Nhon Trach 2 - Loc Khang | 70 | 70 | 42,54 | 27 | 63,47 |

| 14 | Nhon Trach 3 (Zone no# 1) | 337 | 337 | 233,85 | 233,85 | 100 |

| 14 | Nhon Trach 3 (Zone no# 2) | 351 | 351 | 227,55 | 112,13 | 49,28 |

| 15 | Nhon Trach 5 | 302 | 302 | 205 | 184,03 | 89,77 |

| 16 | Nhon Trach Textile | 184 | 184 | 121 | 100,77 | 83,28 |

| 17 | Dinh Quan | 130 | 54 | 37,8 | 44,9 | 118,78 |

| 18 | Xuan Loc | 303 | 109 | 63,88 | 40,05 | 62,7 |

| 19 | Thanh Phu | 177 | 177 | 124,15 | 58,15 | 46,84 |

| 20 | Bau Xeo | 500 | 500 | 328,08 | 306,53 | 93,43 |

| 21 | Tan Phu | 54 | 54 | 34,98 | 4,26 | 12,19 |

| 22 | Agtex Long Binh | 43 | 43 | 27,62 | 26,48 | 95,88 |

| 23 | Ong Keo | 823,45 | 823,45 | 485,19 | 425,06 | 87,61 |

| 24 | Dau Giay | 330,8 | 330,8 | 192,47 | 6,52 | 3,39 |

| 25 | Suoi Tre | 150 | 150 | 95,9 | 13,02 | 13,6 |

| 8.251,25 | 7.210,25 | 4.788,18 | 3.881,95 | 81,1 |

| II. Industrial Parks under the process of preparing infrastructure |

| Number | Name | Total planned area size (ha) |

Area size (ha) |

Rental area size (ha) |

Rented area size (ha) |

Filling ratio (%) |

|---|---|---|---|---|---|---|

| 26 | Long Khanh | 264,47 | 264,47 | 158,01 | 3 | |

| 27 | Nhon Trach 6 | 315 | 315 | 220,29 | 0 | |

| 28 | An Phuoc | 201 | 130 | 91 | 0 | |

| 29 | Loc An - Binh Son | 497,77 | 497,77 | 319,57 | 0 | |

| 30 | Giang Dien | 529 | 529 | 319,58 | 5 | |

| 31 | Long Duc (Zone no# 1) | 283 | 283 | 183,29 | 0 | |

| 31 | Long Duc (Zone no# 2) | 297 | 0 | 0 | 0 | |

| 2.387,24 | 2.019,24 | 1.291,74 | 8 |

| III. Industrial parks under preparation for investments |

| Number | Name | Total planned area size (ha) |

Area size (ha) |

Rental area size (ha) |

Rented area size (ha) |

Filling ratio (%) |

|---|---|---|---|---|---|---|

| 32 | Phuoc Binh | 190 | ||||

| 33 | Cam My | 300 | ||||

| 34 | Gia Kiem | 330 | ||||

| 820 |

| IV. Other specialized establishments |

| Number | Name | Total planned area size (ha) |

Area size (ha) |

Rental area size (ha) |

Rented area size (ha) |

Filling ratio (%) |

|---|---|---|---|---|---|---|

| 35 | Dong Nai Bio-Tech Center | 209 | 209 | 120 | 62 | 52 |

| 36 | Long Thanh High-Tech Industrial Park | 500 | ||||

| 37 | Dofico Agro-Industrial Complex | 2.186 | ||||

| 2.895 |

INVESTMENT

Processing cashew in Bien Hoa

1. Locations that encourage investment:

Dong Nai wants to encourage investors to invest in the following districts

Thong Nhat, Tan Phu, Đinh Quan, Xuan Loc, Cam My. In particular, industrial

production projects should focus on industrial parts, and industrial clusters

according to approved plans.

2. Investments are encouraged for the following

fields:

The province of Dong Nai creates favorable conditions for investors to find

investment opportunities in all industries that are in conformity with WTO

regulations, and other agreements between the government and the international

community. In particular, investments are especially welcomed in the following

fields:

a. Industry:

- High-tech projects.

- Supporting industries: production of components, details, spare parts, raw

materials for mechanic production, electronic- computer, ensemblance of automobiles,

textile, footwear, and supporting industries for high-tech development.

- Production of new materials, energy conservation projects, environmentally

friendly projects.

- Software production, computer technology.

b. Agriculture and processing industry:

- Agricultural productions that use bio-tech.

- Production of food trees, productive high-quality livestock that ensure

food safety.

- Food processing projects.

- Pharmaceutical products and materials.

c. Other fields:

- Infrastructural technology: investment in bridges, road network, joint-effort

sea ports, logistics.

- Other investment projects belong to the following fields: education, healthcare,

sport, tourism, workers’ housing.

3. INTRODUCTION OF SOME BUSINESSES AND PROJECTS THAT ARE CALLING FOR INVESTMENT IN DONG NAI

(Click company for more information)

- Tin Nghia Corporation (TIMEX)

- Industrial Park Development Corporation (SONADEZI)

- Dong Nai Agricultural Corporation (DOFICO)

- Amata joint-stock company (Vietnam)

- Limited liability investment company Long Duc

- Long Khanh Industrial Park Joint-Stock Company

- Dau Giay Industrial Park Joint - Stock Company

CONTACT INFORMATION

Administration unit

84-61- số điện thoại

hoặc số fax (nước ngoài)

061- số điện thoại hoặc số fax (trong nước)

| 1.The People Committee of Dong Nai | Address: No. 2, Nguyen Van Tri, Bien

Hoa, Dong Nai, Viet Nam |

|---|---|

| 2.Dong Nai Department of Planning and Investment | Address: No. 2, Nguyen Van Tri, Bien

Hoa, Dong Nai, Viet Nam |

| 3.Dong Nai industry park management board | Address : No# 26, 2A Street, Bien

Hoa 2 Industrial Park, Bien Hoa, Dong Nai, Viet Nam |

| 4. Dong Nai Department of Commerce | Address: No# 2, Nguyen Van Tri, Bien

Hoa, Dong Nai, Viet Nam |

| 5. Dong Nai Department of Sciences and Technology | Address: 260 Pham Van Thuan, Thong

Nhat ward, Bien Hoa, Dong Nai, Viet Nam |

| 6. Dong Nai Customs Department | Address: No# 9A, Dong Khoi, Bien Hoa,

Dong Nai, Viet Nam |

| 7. Dong Nai Tax Department | Address: No# 87, Cach Mang Thang Tam,

Bien Haa, Dong Nai, Viet Nam |

| 8. JAPANESE INVESTORS SEEKING INFORMATION ABOUT DONG NAI: | N. I. C. D. Co., Ltd. (Network of International Cooperation

for Development) |

Infrastructure Investment Unit

84-61- số điện thoại

hoặc số fax (nước ngoài)

061- số điện thoại hoặc số fax (trong nước)

| Name of the Industrial Park | Infrastructure Investment Unit |

| - Bien Hoa 1 Ind. Park

- Xuan Loc Ind. Park - Giang Dien Ind. Park |

Industrial Park Development Corporation (Sonadezi) |

|---|---|

| - Bien Hoa 2 Ind. Park

- Go Dau Ind. Park |

Sonadezi Long Binh Joint - Stock Company (SZB) |

| - Amata Ind. Park - Long Thanh High-Tech Ind. Park |

AMATA Viet Nam Joint - Stock Company |

| - Loteco Ind. Park |

Công ty phát triển KCN Long

Bình (LOTECO) |

| - Ho Nai Ind. Park |

Ho Nai Industrial Park Joint-Stock Company |

| - Song May Ind. Park |

Song May Industrial Park Development LD company |

| - Long Thanh Ind. Park |

Sonadezi Long Thanh Joint-Stock Company |

| - Tam Phuoc Ind. Park - An Phuoc Ind. Park - Tan Phu Ind. Park - Nhon Trach 3 Ind. Park - Nhon Trach 6 Ind. Park - Ong Keo Ind. Park |

Tin Nghia Corporation (TIMEX) |

| - Nhon Trach 1 Ind. Park |

Industry Park and Urban Development Company IDICO (IDICO-URBIZ) |

| - Nhon Trach 2 Ind. Park |

Urban-Industrial Development Joint-Stock Company No# 2

(D2D) |

| - Nhon Trach 2 - Nhon Phu Ind. Park |

Thao Dien Joint-stock Company |

| - Nhon Trach 2 - Loc Khang Ind. Park |

Limited Liability Commerce and Investment Company Loc

Khang |

| - Nhon Trach 5 Ind. Park |

Vietnam Urban and Industrial Development Corporation (IDICO) |

| - Nhon Trach Textile

Ind. Park |

Vinatex Tan Tao Investment Joint - Stock Company |

| - Dinh Quan Ind. Park |

Development of Highland Industrial parks’ Infrastructure

Company |

| - Thanh Phu Ind. Park |

Dong Nai Traffic Construction Joint - Stock Company |

| - Bau Xeo Ind. Park |

Thong Nhat Joint - Stock Company |

| - Agtex Long Binh Ind.

Park |

28 Corporation |

| - Long Duc Ind. Park

|

Long Duc Limited Liability Investment Company |

| - Long Khanh Ind. Park |

Long Khanh Industrial Park Joint - Stock Company |

| - Dau Giay Ind. Park |

Dau Giay Industrial Park Joint - Stock Company |

| - Loc An - Binh Son Ind.

Park |

.R.G Long Thanh Investment and Development Joint - Stock

Company |

| - Suoi Tre Ind. Park |

Sonadezi An Binh Joint-stock Company |

| Dofico Agro-Industrial

Complex |

Dong Nai Industrial Food Processing Company |

| Dong Nai Bio-Tech Center |

Dong Nai Bio-Tech Center |

.jpg)

.jpg)

_(1).jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)